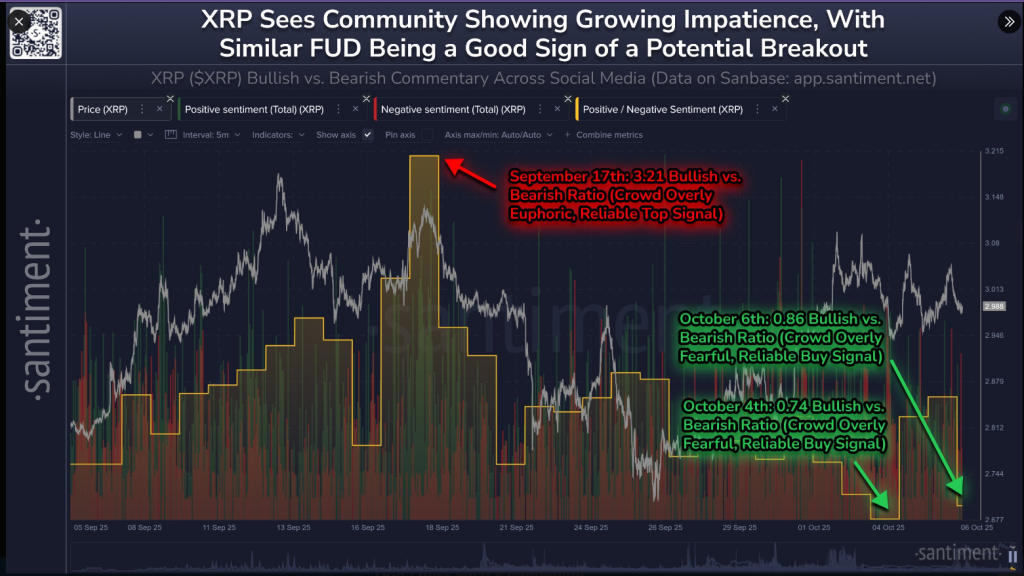

According to Santiment, XRP is seeing its highest level of retail fear, uncertainty and doubt in six months. That surge in negativity is being read by some analysts as a contrarian signal — fear on the street could come just before a turnaround.

While traders grumble, on-chain data shows crowd mood tipping toward worry, and Santiment points out that when retail panic grows, markets have a habit of moving in the opposite direction.

Retail Fear Hits Six-Month High

Based on reports from the blockchain analytics firm, the bullish-to-bearish ratio reached 3.21 on Sept. 17 during a wave of euphoria, then fell to 0.74 on Oct. 4 as frustration rose.

The ratio moved slightly to 0.86 on Oct. 6. Over the last three days tracked, bearish commentary outweighed bullish views for two days, which Santiment interprets as a possible bottom signal.

Traders should note that these mood swings are being measured by crowd talk, and when optimism climbed too high earlier, that was flagged as a reliable top signal.

XRP is seeing it’s highest level of retail FUD since Trump’s tariffs were announced 6 months ago. There have been more bearish comments than bullish for 2 of the past 3 days, which is generally a promising buy signal. Markets move opposite to small trader expectations. pic.twitter.com/flO7jjlo9m

— Santiment (@santimentfeed) October 7, 2025

Technical Levels To Watch

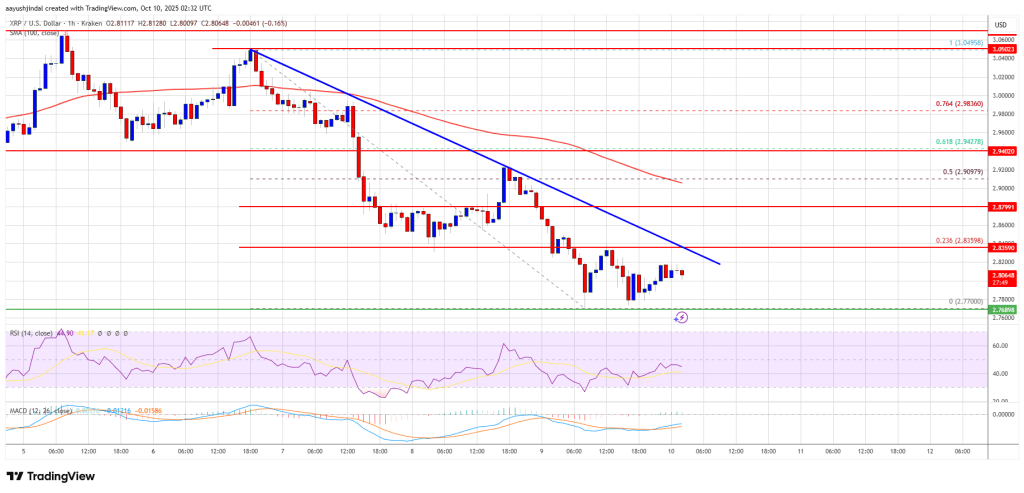

Reports have disclosed key price points that traders are watching closely. XRP is trading at $2.85 and still has not cleared the $3 barrier that it reached briefly in the past few weeks.

Support is placed around $2.60–$2.80, and analyst CryptoInsightUK says the $2.72 to $2.75 zone remains a major structural level.

Holding above that range shows buyers have stepped in repeatedly since the rally from $0.50, the analyst added. Breaks above $3.17 and $3.65 would be seen by some as confirmation of stronger upside momentum.

Analysts Expect A Possible Breakout

Based on technical notes from CryptoInsightUK, a move following the 4.236 Fibonacci extension could reach $6.90, with a larger wave potentially taking prices toward $8–$12.

Meanwhile, professor Astrones has also identified a bullish structure on charts, calling the setup “pumpy” and pointing to a narrowing range that could break higher.

This one is pumpy

First target 5$ pic.twitter.com/LzDFTJVHy5

— ProfessorAstrones (@Astrones2) October 6, 2025

Patterns like a descending triangle can break either way, so traders are watching for a clear close above the stated targets.

In the broader market, Bitcoin has shot to a new high above $126,000, and Ethereum has climbed to within 4% of its record peak.

Yet XRP has struggled to push past $3. That contrast has left some investors scratching their heads. At the same time, XRP has not fallen below $2.60 since the breakout that took it to $3.66 in July, which supports the view that buying interest exists underneath current levels.

For now, data and sentiment point toward a possible setup where fear fades before prices rise.

Featured image from Fingerlakes1.com, chart from TradingView