Bitcoin began October on a strong bullish note, gaining by over 12% to establish a new all-time-high price around $126,100. However, the recent days have presented a troubling amount of selling pressure, especially in the last few hours due to tariff threats from the United States’ President Donald Trump. Amidst this highly volatile environment, on-chain data has also surfaced, highlighting market whales’ confidence in the market.

Bitcoin Whales Are Holding Their Ground

In a QuickTake post on the CryptoQuant platform, a market analyst with the username PelinayPA revealed that there is very little exchange activity among the Bitcoin whales despite the recent fall in Bitcoin’s price. The premier cryptocurrency initially fell below $120,000 on Friday to find support around $116,000 before US President Donald Trump’s statement on tariffs forced a flash crash to around $101,000.

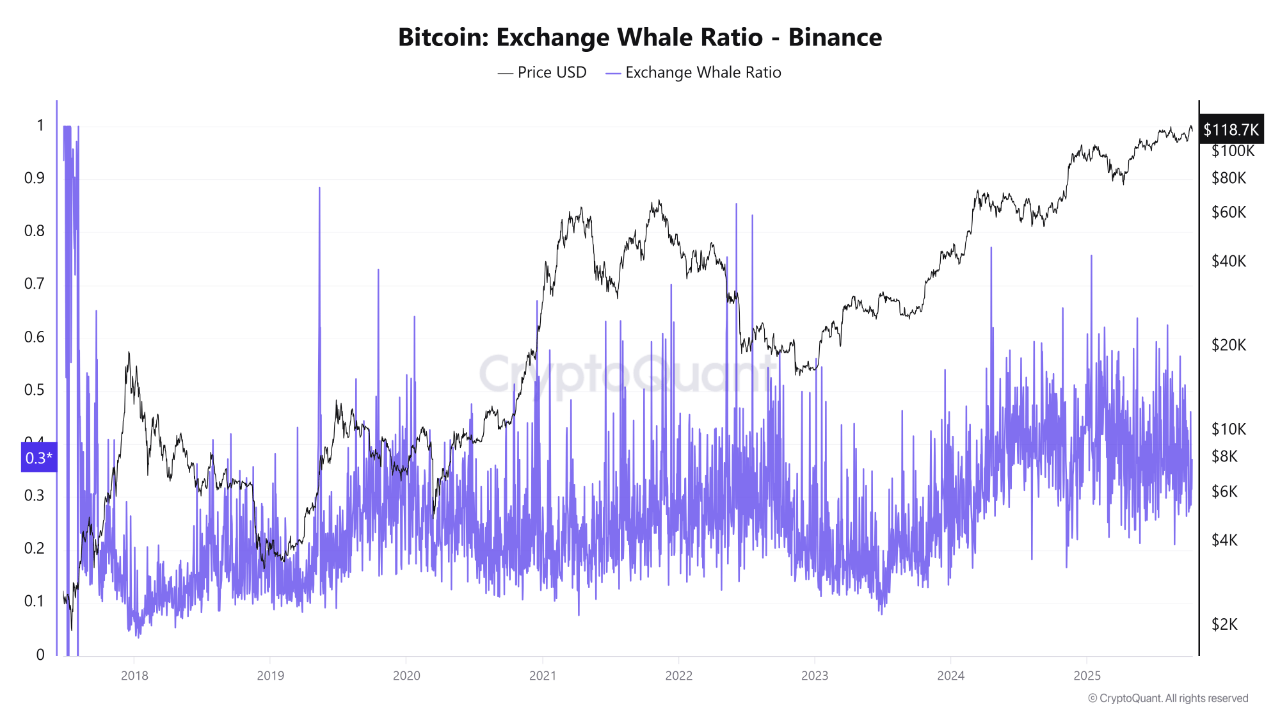

Notably, PelinayPA’s report was based on the Exchange Whale Ratio (EWR), a Binance metric, which tracks the proportion of BTC inflows to the exchanges originating from the top 10 largest addresses. This metric is useful, as it helps analysts assess if large investors are creating increased sell pressure or easing off on the bearish momentum.

A high EWR reading, of values above 0.5, typically indicates high whale inflow to exchanges, either to sell their holdings or exchange for other crypto assets. By extension, increasing exchange activity reflects on price as a boost to its bearish momentum. On the flip side, when the EWR is low, less than 0.3, it usually means that there is low whale activity across exchanges and less of the cryptocurrency is being traded by its top holders.

Interestingly, this conjecture is backed by historical occurrences. Before the 2021 bull market top, PelinayPA notes that EWR spikes were indicating that whales were preparing to sell their holdings. Nearing the end of the 2022 bear market, it is also worth noting that EWR levels were sustained beneath 0.3, showing accumulation and preparation for a bullish run.

The analyst also pointed to the EWR levels from 2024 to 2025. From 2024, “as Bitcoin’s price climbed above $100,000, EWR stabilized around 0.3 and showed fewer sharp surges,” indicating that whales might have been maintaining their positions rather than selling off their holdings. Currently, the EWR levels still stand at 0.3, amidst recent price drops reflecting the Bitcoin whales’ holding a “neutral to supportive” stance with no indication of heavy scale distribution.

What Next For Bitcoin?

Looking ahead, Bitcoin’s next move will likely hinge on how traders respond to shifting macroeconomic conditions and key technical levels. If the EWR rises toward the 0.5 zone, it could indicate growing distribution pressure, meaning that whales may begin transferring holdings to exchanges in anticipation of a market top.

However, if EWR trends lower instead, it would reinforce the current bullish structure, showing that major holders are keeping coins off exchanges and maintaining confidence in the rally. PelinayPA predicts this sustained low EWR would push Bitcoin toward the $163,000 range. Nevertheless, investors may commence profit-taking around $150,000, which represents a psychological resistance.

As of press time, Bitcoin is worth $110,517, with a significant loss of nearly 8.36% in value in just 24 hours.