Dogecoin is showing unexpected resilience while the broader crypto market trades in a weak pattern, according to trader Daan Crypto Trades (@DaanCrypto). In a chart posted on X on November 13, he highlighted a potential “range retake” that could set up a move toward the previous range high at roughly $0.218—if DOGE can break and hold above $0.18.

Dogecoin Bulls Have A Target

“DOGE has been relatively strong the past few days. Overall market is obviously weak and choppy,” he wrote. At the time of his chart, Dogecoin traded around $0.172 on Binance, sitting just below a key green support band marking the range low between $0.17 and $0.18 . The range high—drawn at $0.21817 —remains the upside target if price can reclaim the lower boundary. The distance between the band and the top of the range is 23.1%, a move Daan considers technically clean if momentum aligns.

The trader also pointed to a narrative circulating in US markets: proposed 2,000-dollar stimulus or dividend checks by the Trump administration. He noted the psychological connection many retail traders still have to the “stimmy check” era of 2020–2021, when Dogecoin was one of the cycle’s strongest performers.

“I think the 2,000 dollar stimulus/dividend checks to US workers might have re-ignited some muscle memory,” he said, adding that younger traders often look for speculative assets rather than Bitcoin or Ethereum when deploying unexpected cash.

Technically, the setup he is monitoring is straightforward: DOGE previously broke below its established range, flushed to lower lows, and is now attempting to push back into the band. His chart shows two rounded swing lows, suggesting a potential base forming. A reclaim of the green zone—validated by closing strength above $0.18 —would signal that sellers have lost control and that the upper boundary at $0.218 could come back into focus.

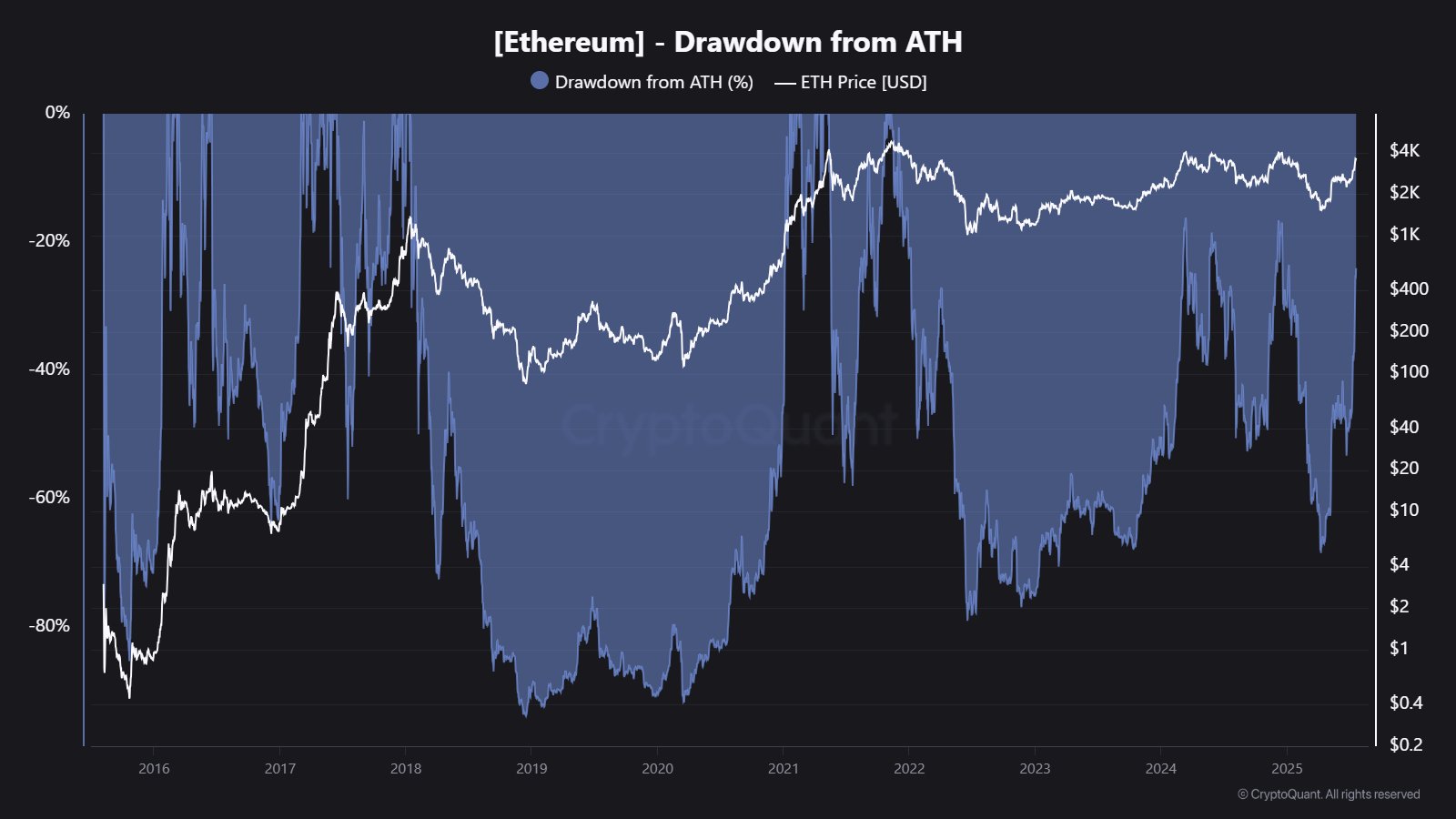

“Regardless of all that, I am watching closely here for this range retake,” he wrote. “I think it could make for a clean setup for a move back to the range highs. Need BTC & ETH to hold the floor for that to play out obviously.” That final clause underscores the conditional nature of his view. Dogecoin often behaves as a high-beta expression of market risk, and Daan is explicit that a broader market breakdown would invalidate the scenario, even if DOGE briefly trades above $0.18.

Questions about his seemingly long-oriented emphasis prompted clarification. One user asked why he focuses mainly on upside setups, prompting Daan to respond: “I do both sides personally for short term scalps. But the moment you post short setups people get quite angry.” He added that long setups tend to offer better risk-to-reward for most traders and that shorting after recent “big liquidation flushes” like the October 10 event is generally less appealing.

His posted chart reflects that preference: a potential bullish reclaim rather than an attempt to fade resistance. For now, the key remains unchanged—confirmation only comes with a sustained break above $0.18. Without that level, Dogecoin stays inside its lower consolidation, with Bitcoin and Ethereum setting the broader context for whether the memecoin can extend its relative strength.

At press time, DOGE traded at $0.15943.