The price of XRP remains stable in an otherwise volatile market, currently selling at $2.15 with a an impressive 13% increase in the last seven days. The cryptocurrency holds on to being part of the top three digital currencies despite indicators pointing in varying directions.

Though short-term price action indicates a period of consolidation, long-term potential for growth continues to be a possibility for investors monitoring this Ripple-supported coin.

Trading Volume Falls But Price Still Resilient

The recent price movement of the coin has been hard to forecast. XRP has established lower highs and lower lows over the last day, leaving everyone wondering which way it will go next. The small 1.20% increase in the last 24 hours might not be the full picture, as the price is currently below today’s high of $2.18.

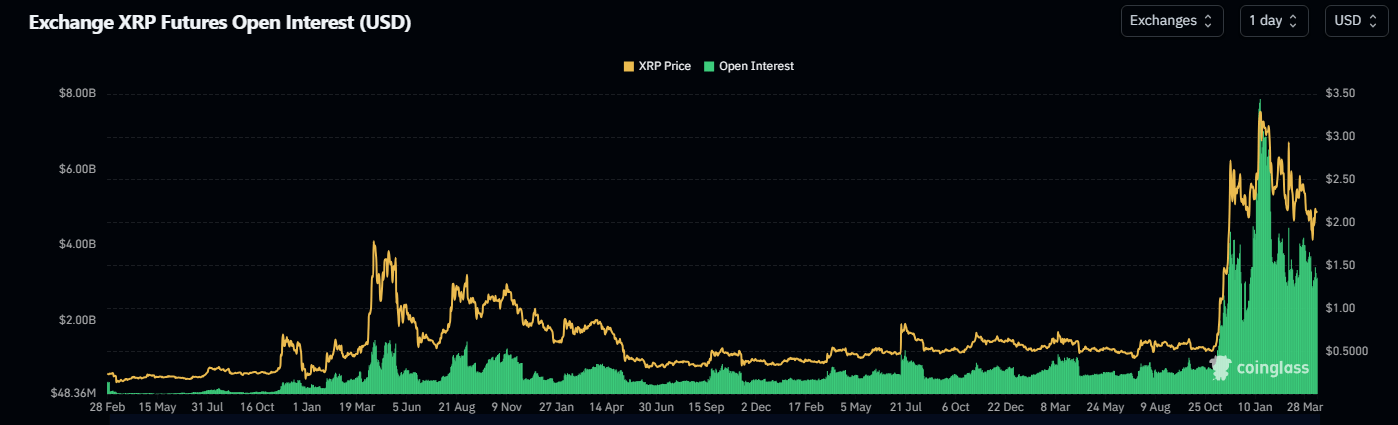

Trading volume has dropped by 12% over the past 24 hours to $3.4 billion, from a high of more than $4 billion. Open Interest has also dropped by over 5%, with just 1.45 billion XRP (valued at $3 billion) locked in futures markets.

In spite of these declining trends in trading activity, XRP’s price has not imploded. Technical indicators suggest a neutral Relative Strength Index (RSI) of 49, which means selling pressure has dissipated. The Bollinger Bands indicator indicates lower price volatility.

Weekly Performance Depicts Optimism

If one looks at the larger time frame, the bigger picture is more optimistic. XRP has risen by 13% in the last week, compared to several other cryptocurrencies.

According to CoinShares’ latest digital asset report, only the top altcoin, XRP, had investment inflows, while both Bitcoin and Ethereum had outflows. This interesting trend is indicative of institutional investor trust in XRP when all other top cryptocurrencies are experiencing selling pressure.

Corporate Developments Might Fuel Future Growth

Ripple Labs’ new business developments may influence the price of XRP in upcoming weeks. The company has acquired Hidden Road, a leading prime brokerage company, which has been its first foray into traditional financial markets.

According to reports, both XRP and RLUSD (Ripple’s USD stablecoin) have roles to play in this development. This conventional finance adoption may increase the price and usage of XRP if the company’s strategy works out.

The future of the cryptocurrency appears to be linked with both global market trends and Ripple’s business growth. Although immediate price movements are unstable with contradictory signs from market indicators, corporate growth and institutional interest offer growth catalysts.

Meanwhile, market technicians are keeping a close eye on major technical levels and trading trends, but the combination of reduced volatility and continued weekly gains indicates XRP might be setting the stage for a more meaningful price move in the near term.

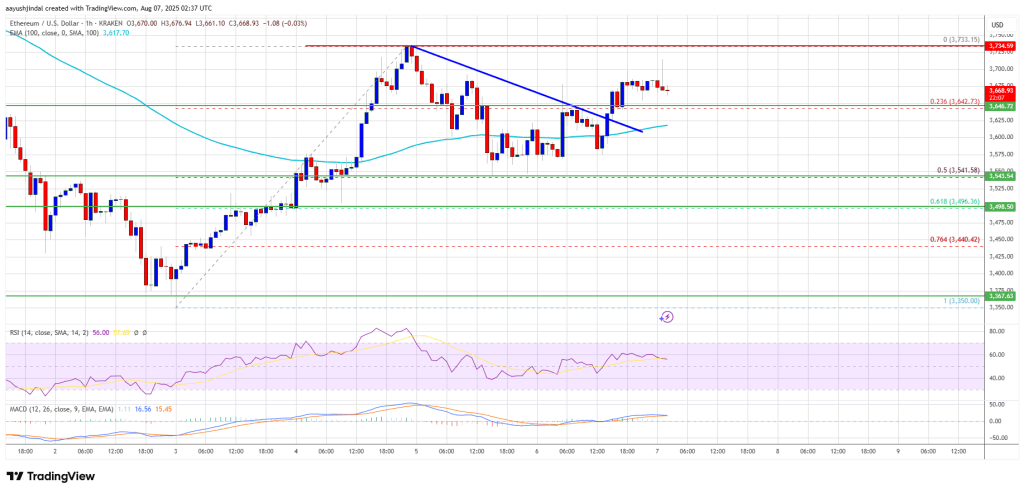

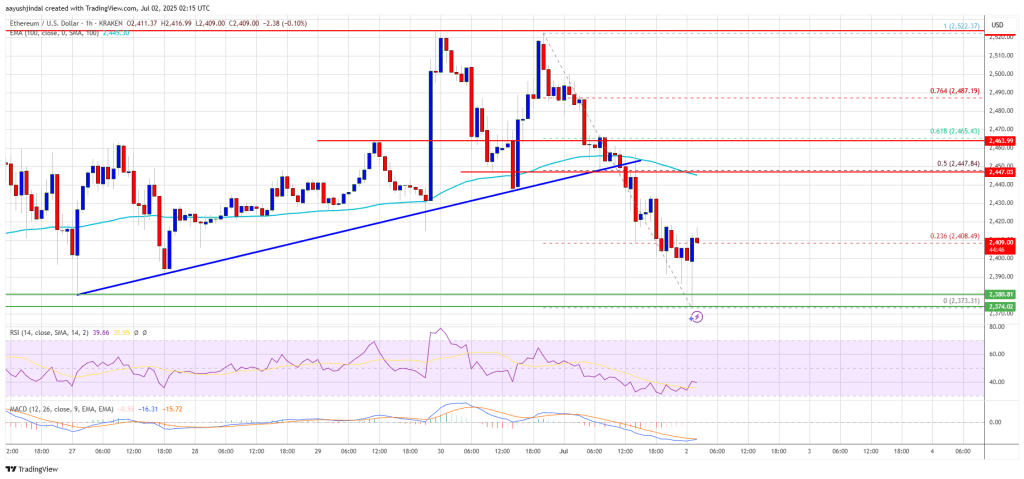

Featured image from Pexels, chart from TradingView